The transaction fee for sending $100 in Bitcoin does not depend on the amount being sent but rather on the network congestion and transaction size. While fees can vary greatly, they typically range from a few cents to several dollars. It’s best to check current network conditions and use a fee estimator for the most accurate rate.

Calculating Bitcoin Transaction Fees

Understanding how Bitcoin transaction fees are calculated is crucial for users looking to optimize their transactions. These fees are not based on the amount of Bitcoin being sent but rather on the size of the transaction in bytes and network conditions.

How Fees are Calculated for Bitcoin Transactions

Bitcoin transaction fees are primarily calculated based on the transaction’s size in bytes and the network’s current demand:

- Transaction Size: This is determined by the number of inputs and outputs in a transaction. Each input and output adds to the transaction’s size.

- Network Demand: When more people are sending transactions, the demand for block space increases, leading to higher fees.

- Fee Rate: Fees are often calculated in satoshis per byte (sat/b). A higher fee rate usually means a quicker confirmation.

Tools and Calculators for Estimating Bitcoin Fees

Several tools and services can help users estimate the necessary transaction fees:

- Blockchain Explorers: Websites like Blockchain.com provide information on current network conditions and average transaction fees.

- Fee Estimators: Online tools and wallet interfaces often feature built-in fee estimators that suggest fees based on current network congestion.

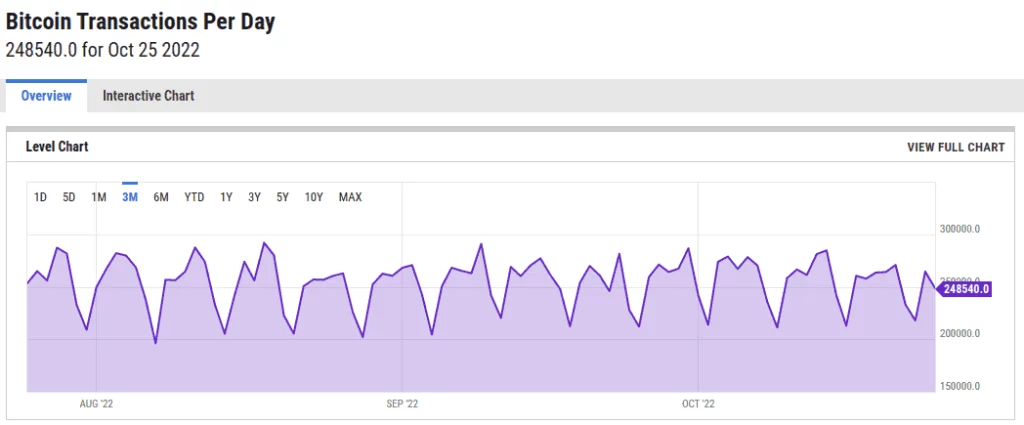

- Bitcoin Fee Charts: Services like BitcoinFees.info offer a visual representation of fee trends and can help users choose an appropriate fee rate.

Example Calculations for $100 Bitcoin Transactions

The fee for a $100 Bitcoin transaction is not based on the amount of money being sent but on the transaction’s size and the network’s condition. For example:

- If the average fee rate is 50 sat/b and your transaction is 250 bytes, the fee would be 12,500 satoshis.

- This fee remains the same whether you’re sending $100 or $1,000 in Bitcoin.

The Role of Transaction Complexity in Fees

Transaction complexity plays a significant role in determining fees:

- Simple Transactions: Transactions with one input and one output are typically smaller and incur lower fees.

- Complex Transactions: Transactions involving multiple inputs (from different addresses) and outputs (sending to multiple addresses) are larger and require higher fees.

- Consolidation: Users can consolidate inputs during times of low network congestion to decrease future transaction sizes and therefore fees.

Factors Influencing Bitcoin Transaction Fees

Several factors can significantly impact the fees associated with Bitcoin transactions. Understanding these can help users make informed decisions about when and how to send Bitcoin.

Network Congestion and Its Impact on Fees

Network congestion occurs when there are more transactions waiting to be confirmed than the network capacity can handle. This leads to the following effects:

- Increased Fees: As users bid higher to get their transactions confirmed faster, average transaction fees rise.

- Delayed Confirmations: Transactions with lower fees may face delays, as miners prioritize higher-fee transactions.

- Strategic Planning: Users may choose to transact during off-peak times to avoid high fees associated with network congestion.

The Role of Bitcoin Miners in Setting Fees

Bitcoin miners play a crucial role in setting transaction fees due to the following factors:

- Fee Market: Miners prioritize transactions with higher fees since the fee acts as an incentive for them to include the transaction in the next block.

- Block Space Limit: Each Bitcoin block has a limited space, creating a competitive market for transaction inclusion.

- Miner Discretion: While miners are incentivized by higher fees, they have the discretion to choose which transactions to include in a block.

How Transaction Size Affects Fees

The size of a Bitcoin transaction in bytes influences the fee, driven by factors like:

- Input and Output Count: Transactions with many inputs or outputs are larger and thus more expensive.

- Data Volume: Additional data included in a transaction, such as multi-sig information, increases its size and, consequently, its fee.

- Efficiency Practices: Utilizing SegWit addresses and batching transactions can reduce the size and cost of transactions.

Time-based Fee Considerations: Urgent vs. Non-Urgent Transactions

The urgency of a transaction determines how much a user might be willing to pay in fees:

- Urgent Transactions: For immediate confirmations, users will likely pay higher fees to outbid other transactions in the mempool.

- Non-Urgent Transactions: If a user is not in a hurry, they can opt to pay lower fees and wait longer for the transaction to be confirmed.

- Timing Strategies: Users can monitor network activity and submit transactions during less busy periods to save on fees while still achieving reasonable confirmation times.

Minimizing Bitcoin Transaction Fees

Reducing transaction costs can enhance the efficiency of Bitcoin transactions. There are several strategies and considerations that can help users minimize fees while still ensuring timely confirmations.

Tips for Reducing Bitcoin Transaction Costs

To reduce Bitcoin transaction fees, consider the following tips:

- Transaction Batching: Combine multiple payments into one transaction to decrease the fee per payment.

- SegWit Addresses: Use SegWit-enabled wallets and addresses to reduce the size of your transactions, thereby lowering fees.

- Time Your Transactions: Plan to transact during off-peak times when the network is less congested.

- Custom Fees: Utilize wallets that allow you to set custom transaction fees instead of opting for the default suggested fee.

Best Times to Send Bitcoin to Reduce Fees

Timing can significantly affect transaction costs:

- Low Traffic Periods: Typically, the Bitcoin network experiences lower traffic during weekends and nighttime (UTC), leading to lower fees.

- Market Trends: Stay updated with market trends and network congestion levels to choose the best time to transact.

- Historical Data: Look at historical fee data to identify patterns in low fee periods.

How to Use Bitcoin Fee Estimators Effectively

Bitcoin fee estimators can guide you in setting appropriate fees:

- Estimator Tools: Utilize online tools or wallet estimators that analyze current network conditions to suggest fees.

- Adjustment for Urgency: Adjust the suggested fees based on your transaction urgency; higher for faster confirmations and lower if you can wait.

- Monitoring the Mempool: Observe the mempool size and dynamics to anticipate fee changes and set your transaction fees accordingly.

Understanding SegWit and Its Impact on Fees

Segregated Witness (SegWit) plays a crucial role in fee reduction:

- Decreased Transaction Size: SegWit separates signature information from transaction data, leading to smaller transaction sizes.

- Lower Fees: Smaller transactions incur lower fees because they take up less block space.

- Wider Adoption: As more users adopt SegWit addresses, the average transaction size on the network decreases, contributing to lower fees for everyone.

By employing these strategies, Bitcoin users can minimize transaction fees while maintaining the speed and reliability of their transactions.